With that in mind, let’s look at a variety of the money laundering tendencies we saw in 2022. The notion of cryptocurrency is all about forming an accessible, revolutionary, pseudo-anonymous financial panorama. Yet, as we know, AML plays an integral part in guaranteeing this all-inclusive method to finance doesn’t backfire on itself. Institutions within the crypto trade should fulfill their AML and KYC obligations during the customer onboarding course of. Organizations can scan their prospects on sanctions, Peps, and Adverse Media lists from more than 220 nations using Sanction Scanner’s AML Screening Software.

The significance of AML compliance for crypto exchanges stems from the rising rules imposed by governments worldwide. Countries like China and South Korea have strict restrictions on mining and crypto exchanges, while Japan and Switzerland allow their residents to use crypto exchanges for buying and selling. Companies can hire AML consultants to assist implement policies and controls to battle AML threats. We have been helping companies in complying with the AML laws and identifying suspicious transactions. Fiat foreign money is transformed to cryptocurrency by way of a blockchain buying and selling platform. Many terrorist organizations increase cryptocurrencies through Telegram and Facebook groups.

Peer To Look (p2p) & Decentralized Finance (defi) Service Providers’ Aml Dangers

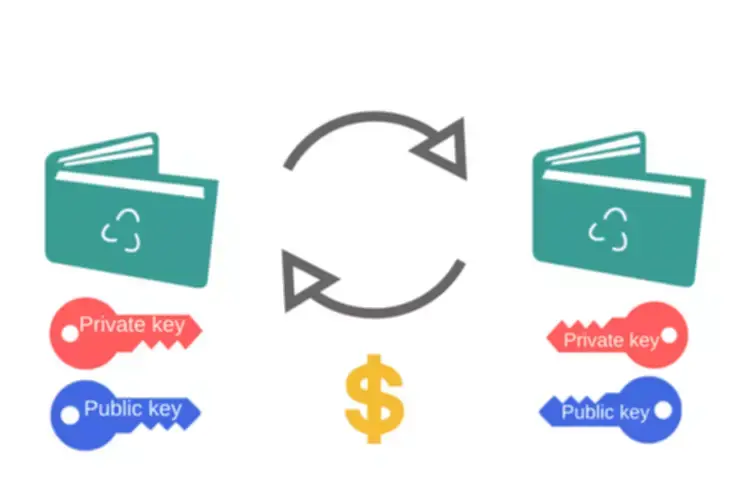

Companies within the crypto industry ought to examine the transactions coming from nations that don’t have the rules the FATF recommends. As the cryptocurrency industry continues to grow and evolve, businesses must prioritize AML compliance to safeguard their operations and preserve the belief of their stakeholders. By implementing strong AML measures, together with KYC procedures, transaction monitoring methods, and ongoing due diligence, cryptocurrency businesses can contribute to the integrity and legitimacy of the industry. In comparability to the opposite digital or non-cash payment strategies that are generally conducted by way of a centralized monetary entity and require an identification of the user in some unspecified time in the future, digital currency transactions are more open to the anonymity of the consumer. In cryptocurrency trading online, there is not a situation to establish the users face-to-face and it is attainable to trade funds anonymously. Anti-money laundering (AML) on the planet of cryptocurrencies covers all the regulations, policies and guidelines that purpose to deliver a halt to the criminals who search to change their illicitly gained cryptocurrency funds with money.

In the European Union, the Fifth Anti-Money Laundering Directive (5 AMLD) has established a set of rules specifically tailor-made to the crypto trade. As these regulations continue to emerge, businesses operating within the crypto business have started adopting monitoring and compliance tools to align with the evolving regulatory panorama. By adhering to these AML rules, crypto exchanges can reveal their commitment to combating financial crimes and ensure a safer surroundings for their customers.

Virtual Currencies – Key Definitions And Potential Aml/cft Risks

Four deposit addresses cracked $100 million in illicit cryptocurrency obtained in 2022, and mixed obtained simply over $1.0 billion, while the 1.2 million deposit addresses receiving beneath $100 in illicit funds account for $38 million in complete. Further, 51% of the $6.three billion in illicit funds received by fiat off-ramp companies in 2022 went to a gaggle https://www.xcritical.com/ of simply 542 deposit addresses. Those numbers represent a lower stage of money laundering focus on the deposit tackle stage than we noticed in 2021, although 2022 noticed a slight uptick in concentration at the service stage.

It will give attention to Anti-Money Laundering (“AML”) and sanctions risks faced by Virtual Asset Service Providers (VASPs), Peer to Peer (P2P) / Decentralized Finance (DeFi) service providers, and traditional financial establishments. It may also spotlight the newly introduced bipartisan legislation and what it’d mean for digital property service providers going ahead. As we stand midway by way of 2023, the regulatory landscape surrounding digital belongings is probably not a high precedence for financial institutions. However, we consider it’s only a matter of time earlier than all financial establishments feel the regulatory stress to have controls in place to particularly identify and mitigate digital asset dangers. Senators’ Elizabeth Warren and Roger Marshall who introduced bipartisan introduced bipartisan laws on December 14, 2022 aimed at addressing risks digital property pose within the aftermath of the FTX collapse.

Tips On How To Mitigate Aml Cryptocurrency Risks

This month’s key compliance news features a crypto trade hack, two Goldman Sachs fines, updated whistleblowing laws,… The FCA has launched some tough rules which are designed to make the marketing of cryptoasset merchandise clearer and more accurate. These guidelines embrace banning incentives like referral bonuses, the inclusion of risk warnings and allowing for a cooling-off interval. Additionally, cryptoassets have facilitated the creation of decentralised purposes (DApps) in fields like healthcare, the place affected person knowledge could be securely managed, and within the gaming trade, allowing for unique in-game belongings and economies. Beyond finance, blockchain technology, which underpins cryptoassets, has been harnessed for supply chain management, ensuring transparency and authenticity of products.

In this case, the underground laundering service, which capabilities equally to a mixer, helped an affiliate for a outstanding ransomware pressure move funds to a deposit tackle at a big, centralized exchange. As talked about within the introduction, all indications recommend aml crypto software it’s a matter of “WHEN not if” a regulatory framework might be developed to handle all parts of digital belongings. The wheels appear to already be in movement with the introduction of the “Digital Asset Anti-Money Laundering Act of 2022”.

Criminals see cryptocurrencies as a handy device to obfuscate the origins and locations of illicit funds, making it difficult for legislation enforcement agencies to track and seize these belongings. Despite the drop in total focus, 51% of illicit funds moving to just 542 deposit addresses at 83 exchanges nonetheless represents a high degree of money laundering focus. If legislation enforcement and compliance groups have been in a position to disrupt the people and teams behind these addresses, it would be rather more difficult for criminals to launder cryptocurrency at scale, and go a great distance toward making the ecosystem safer. Hackers holding stolen cryptocurrency are the one criminal class sending the vast majority of funds to DeFi protocols, at a whopping fifty seven.0%. 2022 was an infinite yr for hacking, hence why these cybercriminals had been almost single-handedly in a position to drive the general increase in the usage of DeFi protocols for money laundering.

They sent the cleaned foreign money to an exterior cryptocurrency pockets within the last switch. Therefore, it’s easier for criminals to maneuver large amounts of illicit funds through blockchain expertise with out disclosing their identification. The absence or lack of controls and rules on cryptocurrencies is the primary reason for an increase in crypto money laundering. Many legal guidelines and rules exist for different financial channels, currencies, and instruments, wherein fines and penalties are imposed for non-compliance with these laws.

their users using it. Such technologies usually are not illegal to use, but corporations ought to be on the safe side. We’ve created a complete AML roadmap to assist you navigate the compliance panorama, supported by a number of monetary crime prevention courses in our Essentials Library. Criminals have always been early adopters of expertise, and cryptocurrency is undoubtedly no exception. Consequently, cryptocurrency has increasingly turn into concerned in almost every legal activity that matters to AML professionals.

Categorizing in style routes helps institutions to concentrate on essentially the most top-level dangers and recognize attribute behavior. AML prevention and detection activities are designed to help create a safer surroundings but when establishments aren’t cautious, they could hinder the user experience of decentralized banking. After all, AML is a balancing act between empowering people to commerce freely and enter crypto markets as they please whereas mitigating the danger of economic crime. Proactive transaction monitoring identifies problematic movements of funds, helping the complete crypto community to change safely. The outcomes of transaction monitoring help create configurable pockets risk scoring so customers can higher perceive who they’re transacting with.

One way of protecting cryptocurrencies from money laundering threats is implementing KYC rules. With KYC norms, exchanges might establish the customers and have information about house owners of virtual wallets and cryptocurrencies. Registration and licensing of operators within the cryptocurrency market can be a solution that can handle the cash laundering concern. They have successfully laundered the unlawful cash but need to point out a authorized supply.

- Criminals see cryptocurrencies as a handy device to obfuscate the origins and locations of illicit funds, making it difficult for legislation enforcement businesses to trace and seize these belongings.

- That’s the place AML practices are obtainable in, to offer a form of much-needed monetary crime governance.

- This digitalization phenomenon has had a profound impact on varied domains, including technological advancements, digitalized operational processes, synthetic intelligence-based systems, cloud technologies, and blockchain-powered solutions.

- Overall, illicit addresses despatched almost $23.eight billion price of cryptocurrency in 2022, a sixty eight.0% increase over 2021.

- In the USA, all of the transactions that involve cryptocurrencies should undergo the KYC processes.

- Recipients should consult their own advisors earlier than making these type of choices.

Its presence in financial onboarding and other key cryptocurrency processes is only set to grow as new transacting methods emerge and the variety of individuals participating in cryptocurrency exercise will increase. The number of cryptocurrencies which are actively exchanged is roughly 20,000 and it gets bigger each day as new cryptocurrencies proceed to pop up available in the market. The highest total value of all of the cryptocurrencies hit $2.9 trillion at the finish of 2021.

How Can Regulation Enforcement And Safety Businesses Stop Cryptocurrency Cash Laundering On The Blockchain?

Governments worldwide are grappling with methods to manage the industry, ranging from imposing restrictions to outright bans. Consequently, international and nationwide regulators are frequently announcing new rules to handle these challenges. To meet worldwide requirements, cryptocurrency corporations and exchanges at the second are beneath strain to implement comprehensive AML screening procedures. Authorities constantly face new challenges of their investigations as a result of increasingly sophisticated cash laundering methods.

The existence of regulatory gaps in AML rules has offered an avenue for criminals to exploit cryptocurrencies for money laundering, financing terrorist teams, bribery, and fraud. In response, regulators worldwide are implementing stricter regulations to combat monetary crimes and help organizations throughout the crypto trade. Anti-Money Laundering (AML) refers to a set of laws, laws, and procedures aimed toward detecting and preventing the illicit acquisition and use of funds derived from illegal actions.

In whole, we see that over half of funds despatched from illicit addresses travel on to centralized exchanges, both mainstream and high-risk, where they are often exchanged for fiat until compliance groups take motion. However, over 40% of illicit funds transfer first to intermediary providers — primarily mixers and illicit services or DeFi protocols —, with most of those funds coming from ransomware, darknet market, and hacker addresses. More illicit funds had been sent to DeFi protocols than ever earlier than, a continuation of a pattern that started in 2020. Cybercriminals ship funds to DeFi protocols not as a outcome of DeFi is helpful for obscuring the move of funds. In reality, fairly the alternative is true, as unlike with centralized services, all activity is recorded on-chain. Keep in mind too that DeFi protocols don’t allow for the conversion of cryptocurrency into fiat, so most of those funds probably moved next to different services, including fiat off-ramps.