S.V. Jare Enterprises & his staff is highly professional in recommending the best possible solutions in helping us buy land in Pune. The Team has delivered highest calibre of Service & has given attention to details.

Email us : svjareenetrprisessales@gmail.com

Over the

Years...

80+

YEARS OF EXPERIENCE

80+

PROJECTS DELIVERED

80+

HAPPY FAMILIES

S.V. JARE ENTERPRISES

![]()

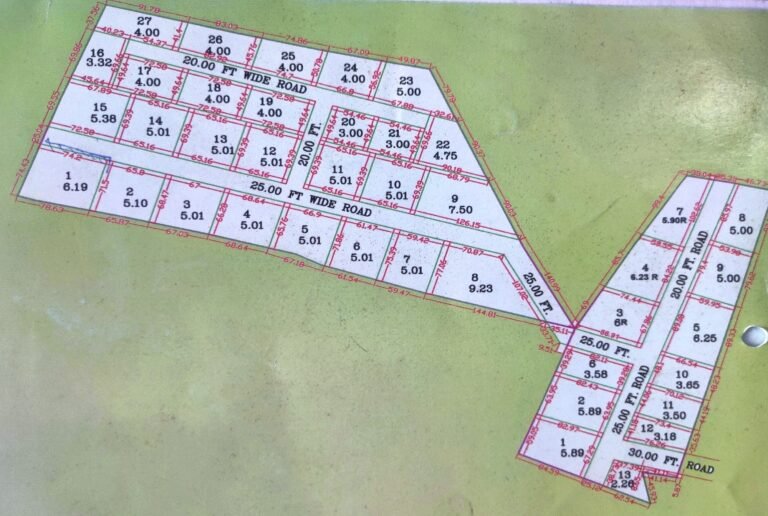

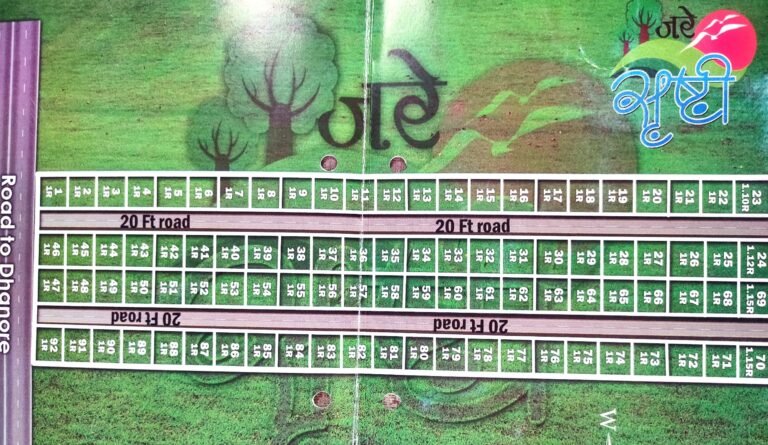

Purchase & Sale

We bring the best of Real Estate Buy & Sale on the table. Be it Commercial, Residential or Industrial, our attention to make a perfect deal is unmatched.

![]()

Professional Team

Our 19 years of work experience and expertise in Real Estate has in itself become a landmark name today in building trust with our customers.

![]()

Value of Money

We provides a wide spectrum of opportunities to make good returns in long run. Happy families & Happy businesses is what we work for!

ABOUT S.V JARE ENTERPRISES

Welcome to S.V. JARE ENTERPRISES, a seasoned industry leader with 20 years of construction experience. Over the past two decades, we have established ourselves as a trusted name, delivering exceptional residential and commercial project results. Our commitment to excellence, attention to detail, and skilled craftsmanship have earned us a reputation for completing projects on time, within budget, and to the highest standards. With a team of experienced professionals and a customer-centric approach, we are dedicated to bringing your vision to life. Choose S V JARE ENTERPRISES for unparalleled expertise and a track record of success.

What our Customers Say

S.V. Jare Enterprises has been very kind in helping us with the Documentation. We were always speculative in buying the land. But his suggestions and inputs has helped us made the right choice and great decision.